You probably never heard this story because it does not reflect well on teachers, prosecutors, or judges. Nobody wants to talk about it, but I do. I was the whistleblower who exposed the scam.

You may not believe what I am about to say, but every word is true — and verifiable.

Twenty two thousand Texans worked for 25 or 30 years as teachers but, on the very last day, they each made an odd career move: They became 6-hour, minimum wage janitors.

I am not the one who discovered this activity. My contribution came later, when I discovered a particular document that made the whole scam illegal.

To understand this fraud, a little background information is required. Here is the common rule that applies to most of us: If you work in a job covered by Social Security, and your spouse also works in a job covered by Social Security, upon retirement you get the greater of two benefits: the benefit based upon your own Social Security earnings or the spousal benefit based upon the earnings of your spouse. You do not get both.

In some states, however, teachers could “double dip,” so to speak. One such state was Texas. There, teachers paid nothing to Social Security: They only paid to their teachers’ pension plan. Because the Social Security Administration did not keep track of teacher pension plans, those educators appeared to be void of retirement resources. As a result, they were given the full spousal benefit.

Eventually, the Social Security Administration caught onto the loophole, but it made a strange (as in corrupt) deal with the teachers. If, on the last day of their employment, they were covered under both Social Security and the teachers’ pension plan, they could continue to double dip. One can only speculate as to the motives. Was it because unionized government workers in Social Security felt a kinship with unionized teachers? Who knows?

That is where I entered the picture, along with the Public Program Testing Organization (PPTO) — a tiny nonprofit organization I founded and directed. I knew that each school in Texas had to opt for Social Security coverage for its employees by electing the coverage with a “Section 218” agreement. In many cases the 218 agreement would extend coverage only to employees in full-time positions, and for many school districts full time was defined by hours per week — not hours per day. Teachers who worked in such districts would not qualify to use the special last-day loophole.

The PPTO and I decided to review each Texas school district, to determine if their teachers qualified for the extra Social Security benefits. To do this, we sent out a flurry of Public Information Requests, requesting Section 218 agreements and personnel policy documents. As the documents came in, it became clear that the teachers in several districts did not qualify for the one-day loophole. We pointed this out to the Social Security Administration and to the school districts. They knew they were cheating the system but did not care.

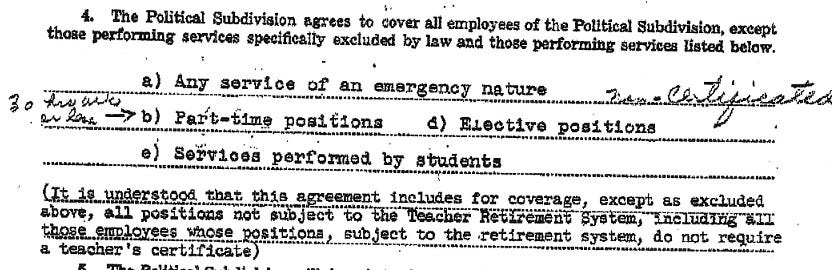

Figure 1: Excerpt from West School District Sect. 218 Agreement

For example, Figure 1 shows part of the Section 218 agreement for the West Independent School district. As you can see, part-time positions were excluded from Social Security coverage, and part-time was defined as “30 hrs week or less.” I also confirmed the 30-hour definition, in writing, with the district’s business manager.

The West school district, and its CPA business manager, had to know that these last-day-loophole janitors did not qualify for Social Security coverage. Yet, the district gave that coverage anyway. Why? Because it was lucrative. West charged these one-day janitors a processing fee of $500 each, which was later increased to $750 each. For that fee, each janitor-teacher made just $33. But don’t feel sorry for these one-day cleaners. They made well over $100,000 each in benefits. Feel sorry for yourself, because you (and I) paid for all of it.

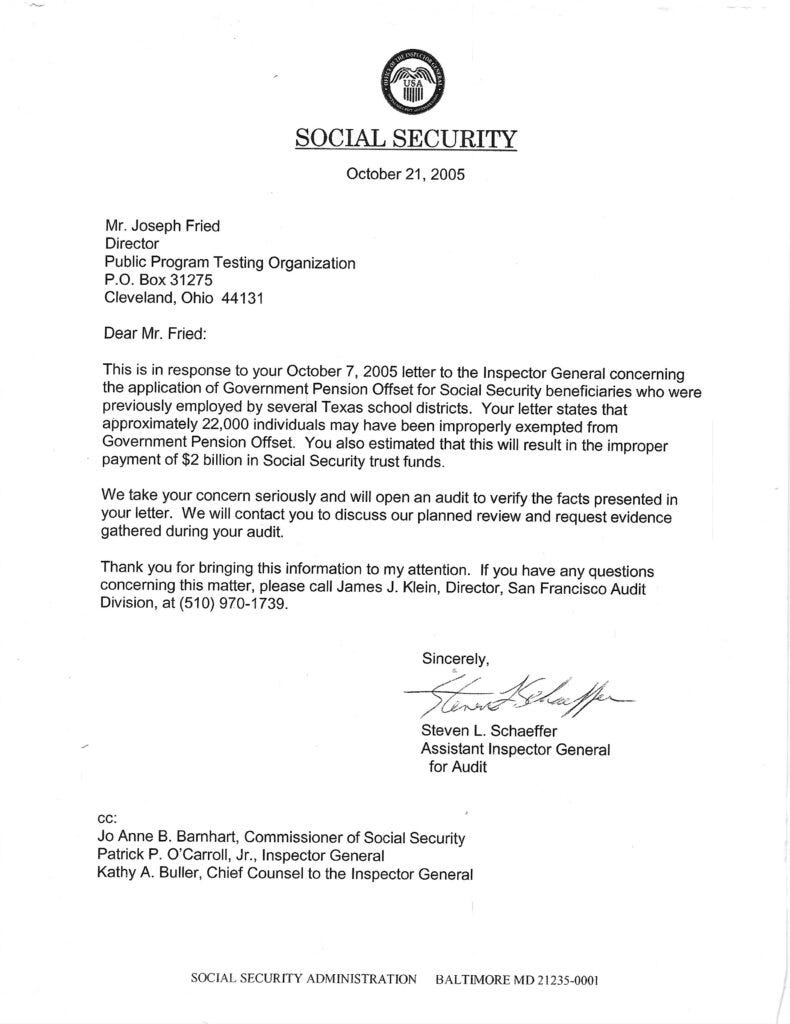

After we collected and analyzed all documents, the PPTO and I sent a 64 page letter of facts and analysis to the Social Security Inspector General. The Assistant Inspector General, Steven L. Schaeffer, responded graciously:

Your letter states that approximately 22,000 individuals may have been improperly exempted from Government Pension Offset [the rule that precludes double dipping]. You also estimated that this will result in the improper payment of $2 billion in Social Security trust funds. We take your concern seriously and will open an audit to verify the facts presented in your letter....

Figure 2: A table from our 64 page letter to the Inspector General

Figure 2 displays a table from our 64 page letter to the Inspector General. To assess the absurdity of these custodial employments, look at the numbers in parentheses, directly next to the names of the schools. Those numbers indicate the student populations of the school districts. In West School District, for example, there were 1,535 students in the school district — less that the 1,795 janitors hired in the Social Security swindle. By employing those cleaners, West made $1,069,000 in fees, but the Social Security trust fund lost about $167,000,000 — just from that one school district.

This is a very long story so I will conclude with the highlights and lowlights.

A year or so after getting our letter, the Office of Inspector General (OIG) completed its audit. The OIG results are slightly different because it limited its analysis to the 7 largest school district programs. However, the OIG’s estimate of damage to the trust fund was about the same (over $2 billion). Its Audit Report (January 2007 A-09-06-26086) is still available to the public, here.

The federal Department of Justice (DOJ) had zero interest in pursuing this case. I had a 2-hour video teleconference with 5 U.S. Attorneys (one from each of the 4 regions of Texas and one from Washington DC.) One of the attorneys said something to the effect that teachers and schools were the good guys, and DOJ policy was to NOT prosecute good guys. Beside, the people in his part of Texas were not wealthy. Therefore, the DOJ wouldn’t pursue this.

At that point, the only option was to file a whistleblower case, where I (and the PPTO) would have to assume responsibility for the legal case. We started by filing against the West and Hudson school districts.

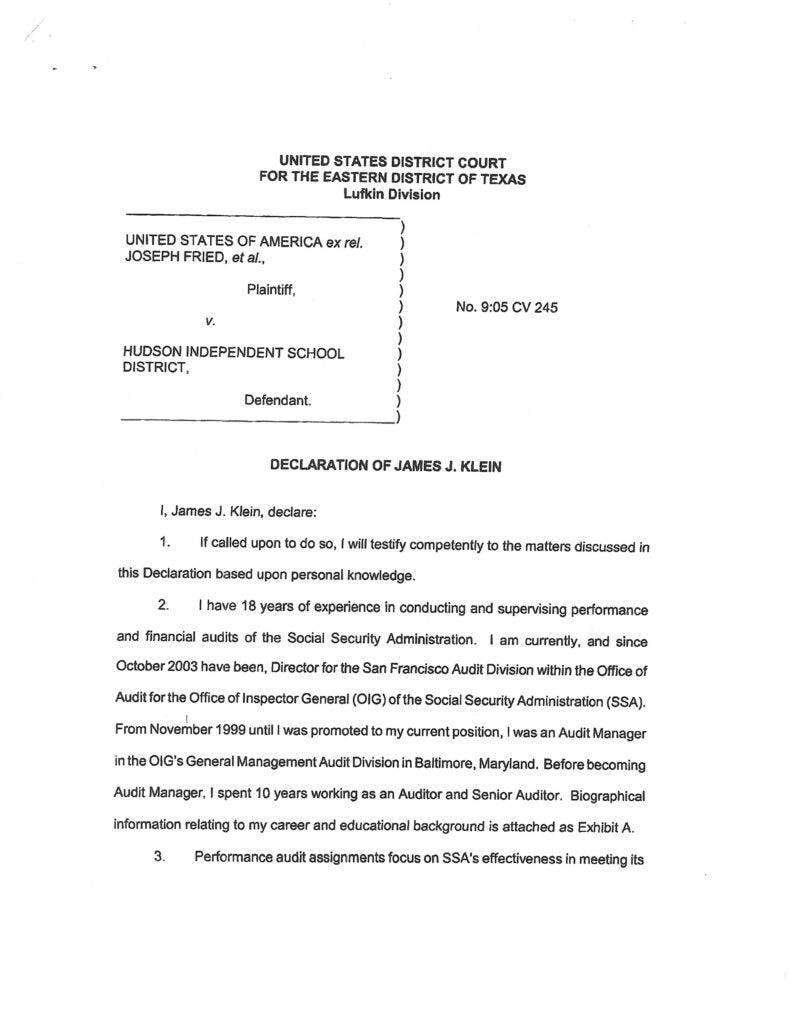

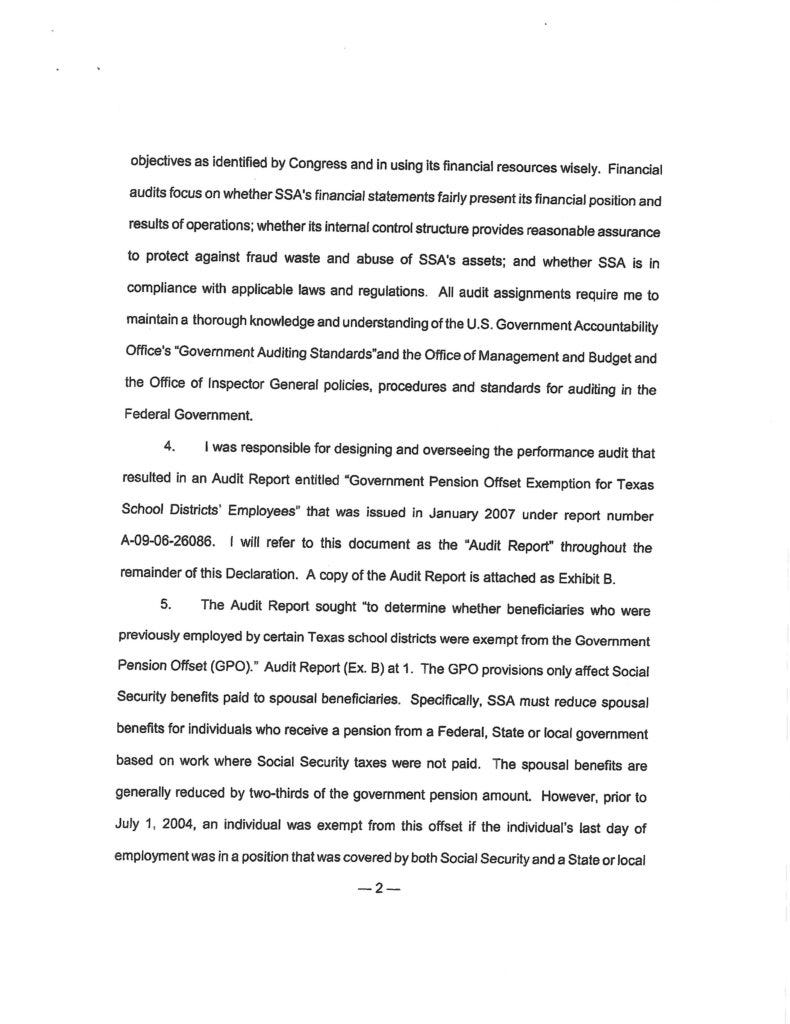

We and our lawyer and the OIG were stunned when federal judges dismissed our cases, claiming we lacked “standing.” A whistleblower has standing if he is the one who brings the case to the governmental agency.

The OIG knew we had standing, so its lead auditor prepared a 6-page Declaration for the court, repeatedly asserting that “Joseph Fried and the Public Program Testing Organization (PPTO) were the source of the allegations and information ...” Our cases were dismissed anyway, without explanation. The cost of appeal was prohibitive, so the cases were dropped. (To see the 6-page letter, click on the link and scroll to the bottom of the page.)

Lessons learned:

In Texas, teachers regarded the Social Security trust fund as their own piggy bank. School districts assisted the teachers in order to make a windfall of fees.

Prosecutors have too much power to pick and choose cases, and to decide who the “good guys” are.

Judges will dismiss a case based on lack of “standing” when they don’t like the case but can’t figure out legitimate grounds for dismissal.

No wonder our Social Security funds are almost gone.

Thanks, Bill!

https://billlawrenceonline.com/how-teachers-swiped-2-billion-from-social-security/